4 August, 2015. Jack Large, Cash & Treasury Management File

Nuapay the Smart collection service from Sentenial, who have been providing payment services to banks and corporates for 10+ years, is different. It takes advantage of the Payment Services Directive in the EU which allows, Sentenial, a non-bank, to become a payment institution. Nuapay is a cloud-based service which gives each corporate user an account plus their own Creditor ID, BIC (Bank Identity Code) and IBAN (International Bank Account Number) to enable them to collect direct debit payments from across the SEPA region.

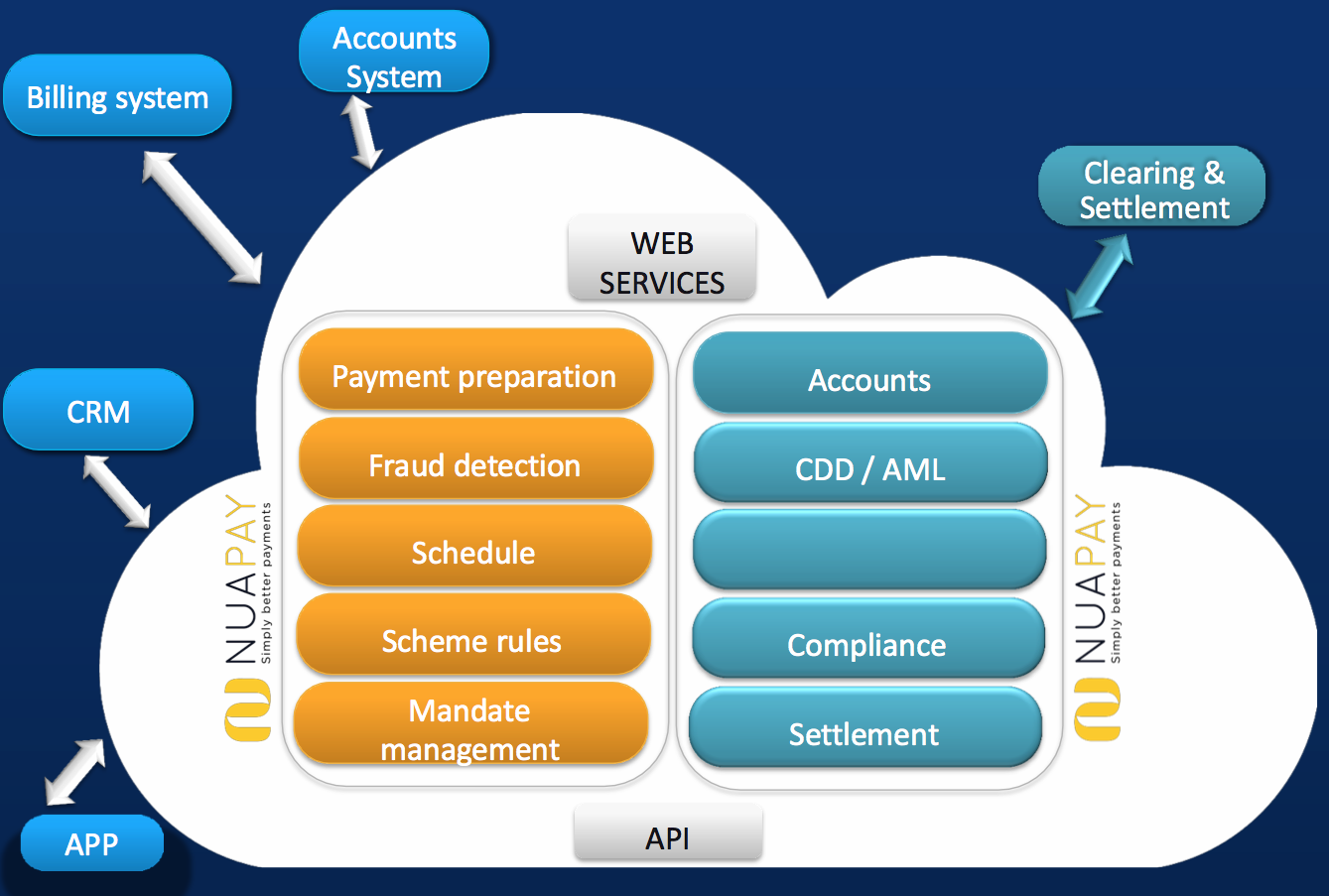

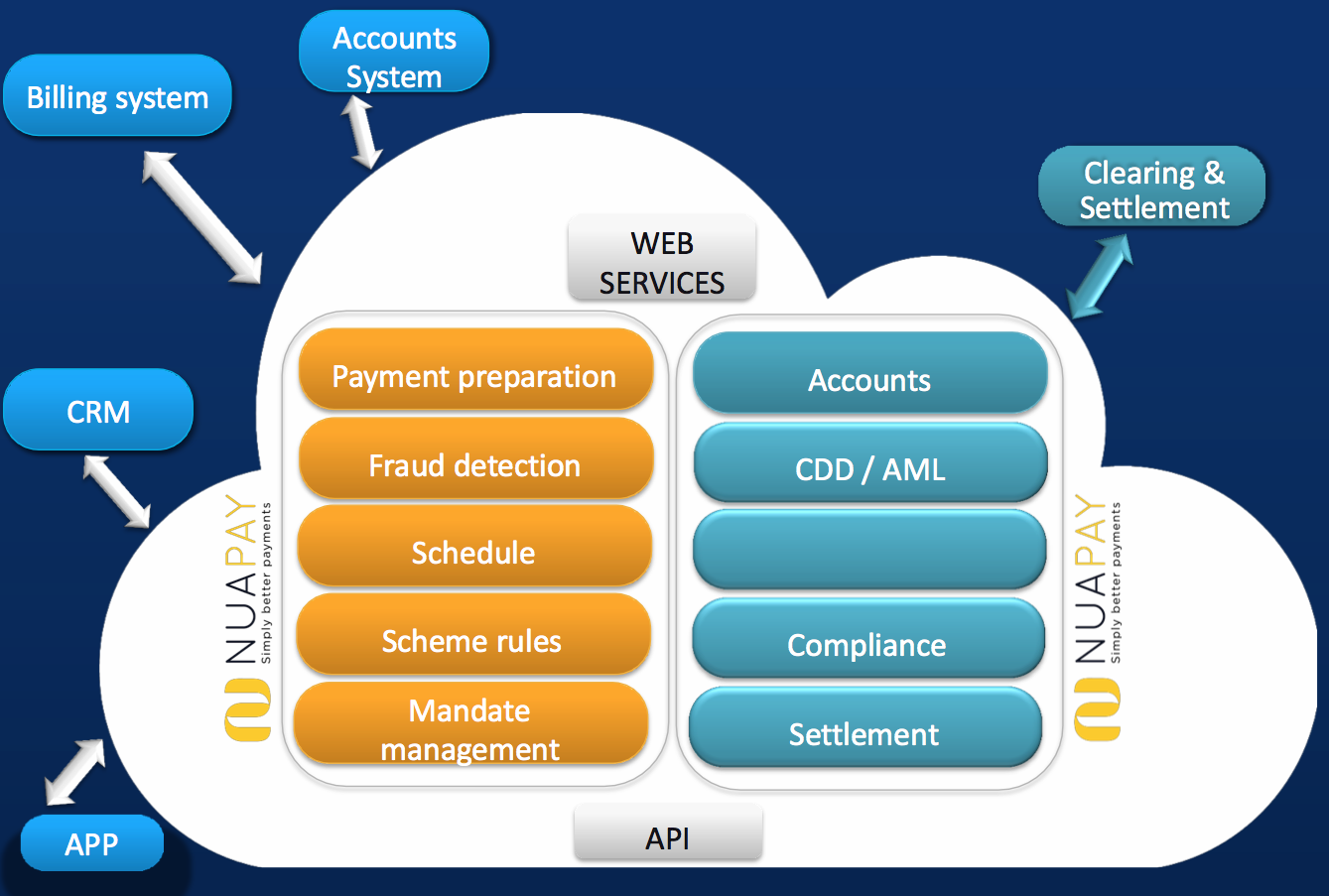

Cloud Based Service

Nuapay uses an API (Application Program Interface) to connect its cloud based service to a client’s own systems. As well as supporting data exchange via files, the APIs also enable real-time integration with other systems and services, as figure below shows.

NuaPay – the smart collect cloud based service

Source & Copyright©2015 – Sentenial

The Nuapay platform is well established processing €30 bn/year. Nuapay users, who range from SMEs, e.g. small charities, to large MNCs in the ‘on-line space’ who collect direct debits from multiple-countries, don’t need to switch banks, they just have to sign up fo Nuapay. If already collecting direct debits – users simply send the files they previously sent to their bank to Nuapay instead. Payments will continue to be processed as normal.

If new to direct debit – mandates are provided (both paper and paperless) to sign up payers. All the software required to run direct debits is included as standard with Nuapay, e.g. mandate management, payment scheduler, reporting etc.

Fees are based on a pay-as-you-go principle based on the transaction volumes processed taking into account of any complimentary services used. A fixed price model is used for SMEs with tiered pricing used when customers are processing large numbers of transactions. Pricing is pitched to be competitive with bank prices with users also benefiting from efficiency gains that can be achieved by using the features offered by Nuapay.

Mandate Management

SEPA Direct Debit (SDD) e-mandates vary by country with an e-mandate in the user’s home country not necessarily being accepted in another country. To solve this problem Sentenial provide an e-mandate e product that users can plug into their web-site allowing users to set up direct debit mandates in any country and any bank employing the appropriate signing protocol, as the figure below shows:

Sentenial e-mandate process

Source & Copyright©2015 – Sentenial

Sentenial provide this e-mandate service as a stand-alone package or as part of Nuapay. Users are also issued with a direct debit creditor ID if required.

Payment Reconciliation

Reconciling all payment activity within an organisation is generally a major time consuming problem often involving several separate systems as well as various accounting ledgers. Sentenial claim that the Nuapay API structure enables individual elements, whether they be systems or individual ledgers within a larger system, to have access to all aspects of payment information in real time, as figure below shows:

For example, when a payment is initiated the APIs can be used to update the initiating system as well as updating the accounts system and the bank ledger all simultaneously and all in real time. Similarly, all elements can be updated should the payment fail for whatever reason. Importantly where Nuapay is used all payments flow through Nuapay accounts which are also fully accessible via the APIs

Sentenial claim that using the APIs can result in considerable improvement in efficiency as data can be posted to the right system at the right time automatically and also, if fully deployed, the user environment will be synchronised and self-balancing reducing the need for reconciliation.

Future Development

Sentenial future development plans for Nuapay, which are restricted to a pan-Europe focus at the moment, include:

- providing SEPA Credit Transfer (SCT) through the Nuapay platform by end of 2015

- adding non-euro currencies – GBP and Norwegian Krone – for local direct debit collections.

The other main focus area for Sentenial, either with Nuapay or with only it’s software solution Origix, will be catering for companies who are now looking to upgrade their SEPA systems, which were implemented in a ‘rushed and fragmented multi-country way’ to meet the compliance date, to fully integrated and efficient collection factories.

CTMfile take: Sentenial’s Nuapay solution shows the importance of non-banks becoming payment institutions. In many cases, they are able to provide much more integrated services than banks, indeed Sentenial are already employed by 10+ banks as part of their payment processing. Moreover, the connectivity that Nuapay provides across all banks is invaluable to the SMEs and mid-size corporates. The reconciliation support is impressive. In the future, mass payments and collections could well be dominated by non-banks.

Sentenial constantly innovates to offer Simply Better Payments.

www.sentenial.com / www.nuapay.com

C&TM Press Article – Pan-European smart collection via Sentenial’s Nuapay opens up new efficiencies